- The Wise Exit

- Posts

- Why You Shouldn't Exit Your Business

Why You Shouldn't Exit Your Business

Until you think about these key things:

Welcome back to another edition of The Wise Exit newsletter. This week, we’re covering:

What to consider and how to plan for your post-exit transition

5 questions to help you avoid post-transaction regret

3 practical steps to create a smoother exit for everyone involved

Let’s dive in.

💡 One Big Idea

Key Things to Consider After You Exit Your Business

When it's finally time to sell your business, most founders and owners are laser-focused on the deal itself — the LOI, due diligence, buyer negotiations.

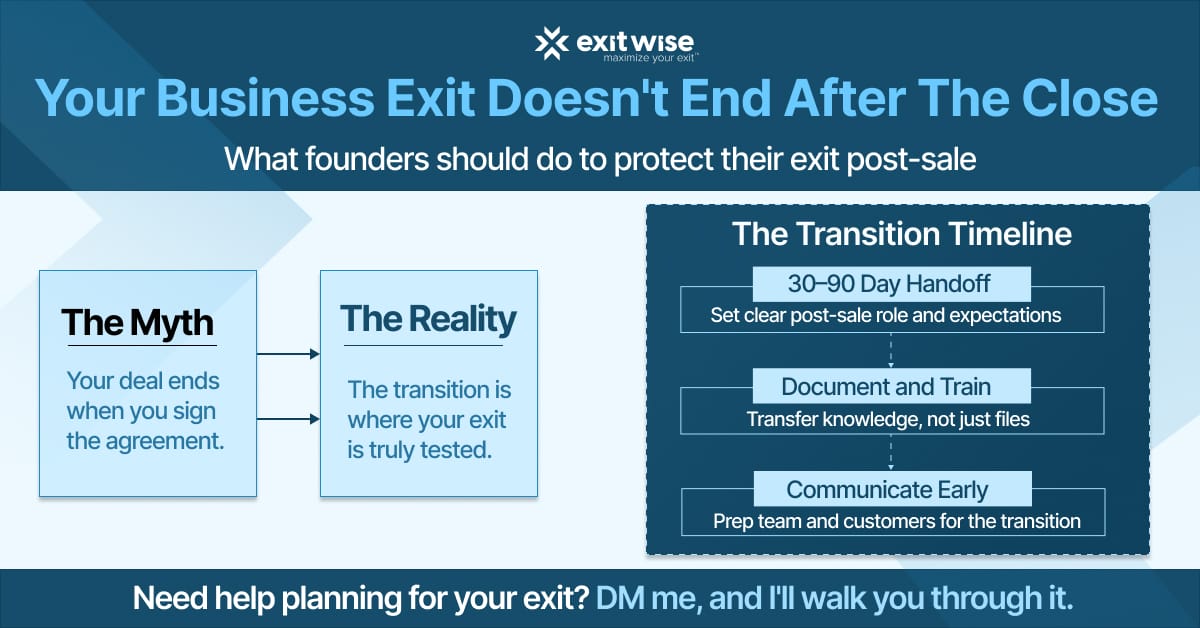

But unlike what you might believe, the moment you sign the purchase agreement isn't the end of the road.

It’s just the beginning of the most overlooked (and delicate) phase of the entire exit process:

The post-sale transition.

It’s where everything you’ve built either holds its value or slowly starts to break.

Because while the buyer may be excited about your business, they’re also quietly asking themselves:

Will customers stay loyal?

Will the team stick around?

Will the business still run without the founder in place?

These are high-stakes questions for everyone involved, and if you haven’t planned for that handoff, they’ll start to answer themselves in ways you may not like.

Founders often underestimate things like how much knowledge lives in their heads, how shaky a handoff can feel to a team that wasn’t looped in, or how emotionally unprepared they are to step away from the thing they've spent so many years building.

The founders who are most satisfied with their exit do a few things:

They carefully design what post-exit life looks like. They negotiate a transition period that makes sense for everyone involved. They document what matters, train the incoming leaders, and communicate early and often with employees and customers.

Because protecting your legacy isn’t just about some big check.

It’s about knowing your business and team will keep thriving, even after it's time to let go.

Your Action Items:

Define your ideal transition period: Would 3 months of consulting do it? Or does a 6–12 month phased-out handoff make more sense? Set boundaries that support success and your freedom.

Document key operations and train your successor: Think beyond basic SOPs — create videos, host walkthroughs, and build reference guides for everything from vendor contacts to culture norms.

Start prepping your team and clients for the shift: A change this big can feel risky for a lot of people. So proactively communicate what's changing, what's not, and why this is a win for everyone involved.

If you want a sample transition roadmap or handoff doc, just reply to this email or DM me. I'll send one over that might work well for your specific situation.

❓ 5 Key Questions to Ask Yourself Today

Before you even think about an exit or talk to a buyer, there are several important questions you should be asking yourself.

The five questions below are anything but easy to answer. In fact, they'll challenge you to think about things you may never have before. But they could be the difference between a clean and confident exit, or one you wish you could take back:

1️⃣ If you walked away from your business tomorrow, what’s the #1 area that would break, and why hasn’t that been fixed yet?

Every transition plan starts by identifying the biggest gap.

2️⃣ How long are you actually willing to stay on post-sale, and what boundaries will protect your time and energy?

Earn-outs and handoffs can feel like “founder limbo” if you’re not clear from the start.

3️⃣ Do your team and customers know what to expect, and have you given them a reason to feel confident in what comes next?

Clarity and communication are your biggest tools for reducing churn and fear.

4️⃣ Does your buyer know how to run the business without relying on you?

If not, you’re not selling a company. You’re renting yourself out.

5️⃣ What does your first 90 days post-exit look like, both personally and professionally?

If you haven’t planned for the emotional and financial transition, it'll sneak up on you faster than you think.

📋 3 Action Items For This Week

☑️ Create a 30-60-90 day transition plan for your buyer: Outline what you’ll help with, when you’ll step back, and what success looks like for them.

☑️ Record walkthroughs of your most essential processes: Use Loom or Zoom to narrate systems, explain workflows, or introduce key vendors and tools so your team is prepared post-exit.

☑️ Block time to plan your “life after exit” on paper: Whether it’s a sabbatical, advisory work, new ventures, or a full retirement, give yourself clarity on what comes next.

That’s all for this week.

Remember, you didn’t build your business just to watch it wobble when you walk away. So plan your handoff carefully, and you’ll exit with clarity, confidence, and pride in what you accomplished.

Need help thinking through your own post-exit transition strategy? Just reply to this email or DM me the word "EXIT," and I'll walk you through it.

Until next time,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.