- The Wise Exit

- Posts

- Why Profit Isn't a Safety Net

Why Profit Isn't a Safety Net

What to know about profitability vs. financial preparation

Welcome back to another edition of The Wise Exit newsletter. Here's what we're covering this week:

The difference between being profitable and being financially prepared

5 things every founder should do this week to improve their cash visibility

3 action steps to reduce the risk of a cash crunch before you exit

Let’s dive in.

💡 This Week’s Big Idea

Why Profit Isn't a Safety Net

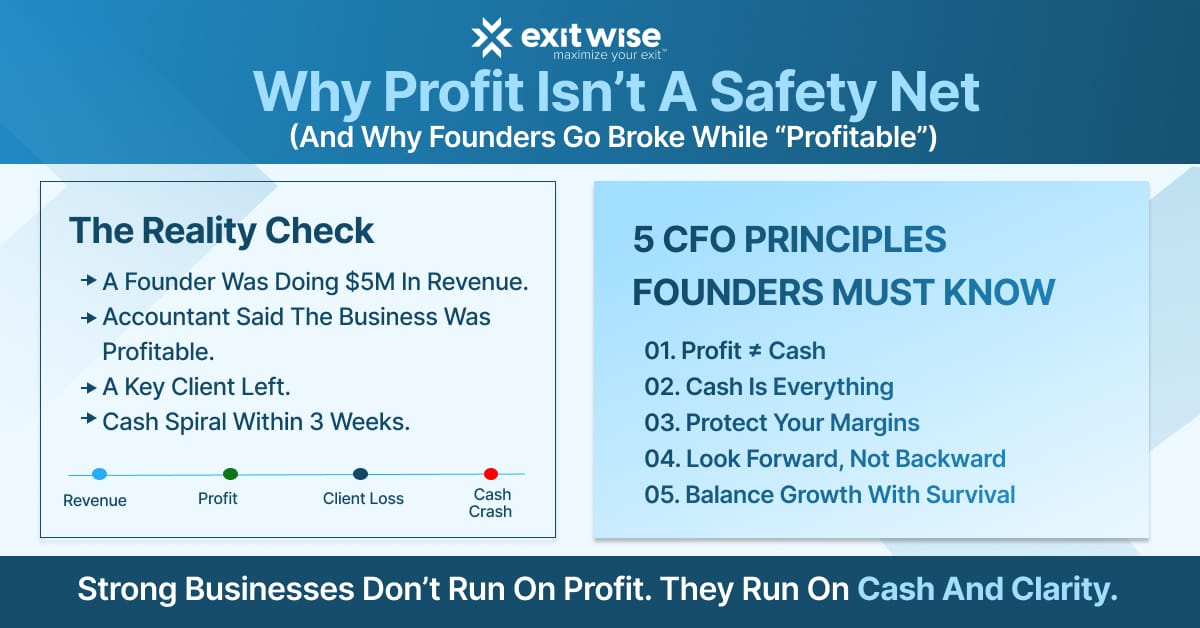

I recently heard a story of a founder who was doing $5M in revenue. Their accountant gave a thumbs-up on the business being profitable. But just three weeks later, the company unexpectedly lost a key client and went into a cash spiral because it turned out they weren't as profitable as they thought.

The reality is, profitability is often just a paper metric. And paper doesn’t pay payroll.

If you’re a founder or business owner preparing for a future exit, financial survivability matters more than your P&L headlines.

Here are 5 key principles we share with every founder we work with to help them think more like a CFO (so they can avoid going into an unexpected cash spiral):

Profit ≠ Cash: Just because your P&L says you made $300K doesn’t mean there’s $300K in the bank. Timing differences, delayed receivables, and inventory costs can often create a dangerous cash gap, even when your business appears “profitable.” Always check your bank balance before making any decisions you might regret down the line.

Cash is everything: As a founder, you should always know how many months of runway your current cash position gives you, assuming sales slowed down tomorrow. If that number surprises you, your business is more fragile than you think.

Protect your margins: Don’t wait for a downturn to fix pricing or weed out low-margin work. As companies grow, volume hides problems... but buyers will always find them. So my recommendation is to raise prices, renegotiate contracts, or cut unnecessary complexity now before it's too late.

Look forward, not backwards: Historical reports are great, but they won’t help you plan for the future. You need a rolling 90-day forward cash view — something you update weekly and use to stress-test decisions.

Balance growth with survival: It’s easy to chase growth by hiring or launching before you’re ready. But growth without safety is just risk with good branding. Don’t spend a dollar unless you know how long your cash can carry the risk if things don’t go as planned.

Having this financial mindset is about building a resilient and sustainable business for the long run. You don’t have to act like a CFO every day. But when you start acting like a seller, you definitely need to think like one.

Reply to this email or reach out to me if you need help getting your financials in order.

❓ 5 Key Questions to Ask Yourself This Week

1️⃣ If a client pays late next month, do I know how that impacts payroll?

2️⃣ What’s my real margin by client or product line, not just overall?

3️⃣ What are the top 3 levers that influence cash this month?

4️⃣ When was the last time I updated my 13-week cash flow model?

5️⃣ Do I know what expenses I would cut first if revenue drops suddenly?

✅ 3 Action Items for This Week

☑️ Review last quarter’s bank balances vs. net income: See if your "profit" actually translated to cash in the bank.

☑️ Build or update your 90-day cash flow model: If you don’t have one yet, build it. If you do, review and update it weekly.

☑️ Identify 3 costs that could be cut immediately if needed: Write them down. It’s easier to act when you’ve pre-decided.

That’s all for this week.

Remember that founders don’t usually get caught off guard by a lack of revenue. It's the slow invoice collections, bloated costs, and false comfort that really sneak up on you if you're not careful.

Get ahead of that now. And when you’re ready to talk or need help with this, reply to this email or contact us here.

Talk next week,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.