- The Wise Exit

- Posts

- What Really Happens After You Sign the LOI

What Really Happens After You Sign the LOI

Welcome back to another edition of The Wise Exit newsletter. This week, we're breaking down:

What really happens after you sign your LOI

5 questions to prepare you for what's to come during diligence

3 actions you can take this week to increase your likelihood of a sale

Let’s dive in.

💡 This Week’s Big Idea

What Really Happens After You Sign the LOI

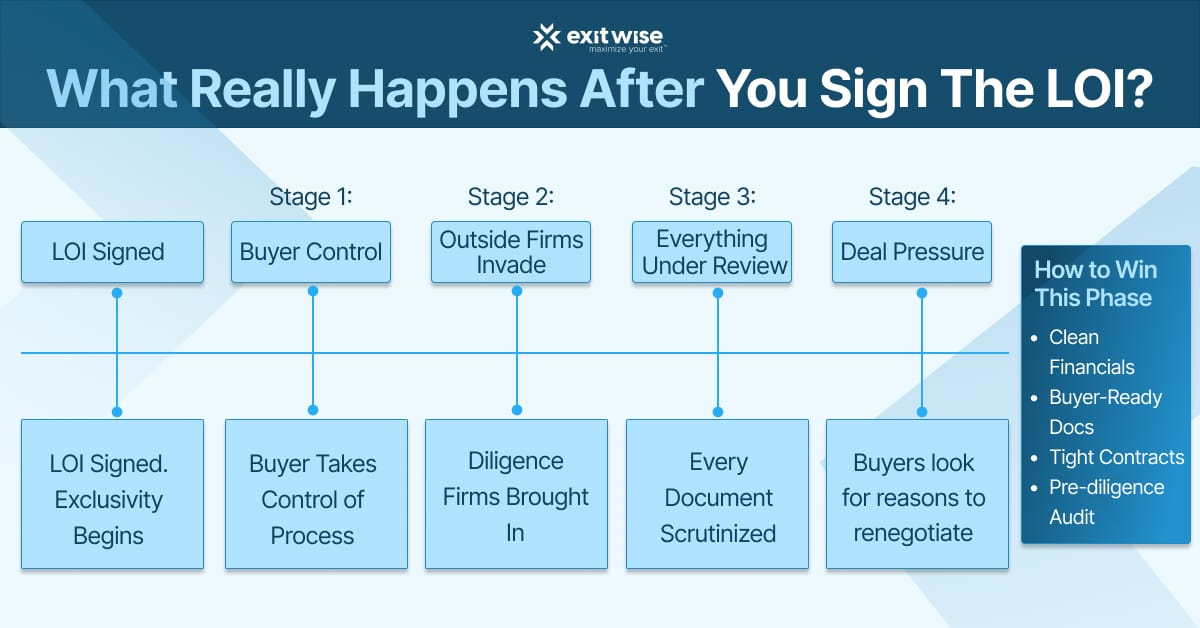

Signing an LOI is a big milestone in your M&A journey. But it’s not the finish line. It’s just the starting gun for the hardest part of the deal:

Due diligence.

Because once exclusivity begins, the tone changes. The buyer is no longer “wooing” you. They’re vetting you. Challenging assumptions. Stress-testing every number.

And they’re not doing it alone, either. They’ll bring in third-party accounting firms, tax advisors, and legal counsel, all digging through your financials, operations, and contracts to uncover anything that could justify a lower price.

Here’s what to expect after signing your LOI:

Diligence kicks off fast: Expect a 30–90 day timeline with intense information requests.

Outside firms take over: Your QuickBooks files, inventory records, employee agreements, and vendor contracts are all under a microscope.

Negotiations re-open behind the scenes: The buyer is looking for leverage to retrace the deal or walk.

You’re now in exclusivity: You can’t talk to other buyers, so your options are limited.

The reality is, the better prepared you are, the less painful this phase becomes.

At Exitwise, we run our clients through a full readiness review before they ever sign an LOI. We check for weak spots in financials, legal gaps in contracts, and operational inefficiencies that could kill a deal later.

That way, when diligence does begin, we’re not reacting. We’re confidently delivering what buyers expect.

And that confidence often leads to better deal terms and fewer surprises.

Reply to this email if you're currently navigating this phase of your M&A journey and have any questions. I'm always happy to help.

5 Key Questions to Ask Yourself This Week

Could I hand over 3 years of financials, tax returns, and payroll data today without edits? If not, your first priority is getting those up to date and audit-ready.

What does my current contract and IP ownership documentation look like? Missing or outdated terms will raise red flags.

Do I have any skeletons in the closet (open legal issues, inflated revenue, hidden debt)? Deal-killers usually come from avoidable surprises.

Is my business’s operational model clearly documented and transferrable? If it only lives in your head, buyers will worry.

Have I spoken with an advisor about what diligence actually looks like? If your only prep is a Google checklist, you're not ready.

3 Action Items for This Week

Audit your data room or central folder system: Make sure financials, legal, and ops documents are up to date and logically organized.

Schedule a 45-minute mock diligence walkthrough with your M&A advisor or CFO: Go through every key area like a buyer would.

Make a list of every external expert you'll need during diligence: Think lawyers, accountants, tax specialists, and ops consultants.

That’s all for this week.

Remember, you don’t have to be perfect. But you do have to be prepared.

Diligence is stressful enough. The last thing you want is to lose a deal because of something you could’ve fixed six months earlier.

Reply to this email or contact us here if you need help with any of the above.

Talk next week,

Brian Dukes Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.