- The Wise Exit

- Posts

- How to Uncover What Your Business is Actually Worth

How to Uncover What Your Business is Actually Worth

And what it means for your exit

Welcome back to another edition of The Wise Exit newsletter. This week, we’re covering:

How to uncover what your business is actually worth (and why it matters for your exit)

5 challenging questions that will pressure-test your exit readiness

3 actionable steps you can take this week to prepare for your exit

Let’s get to it.

This Week's Announcement

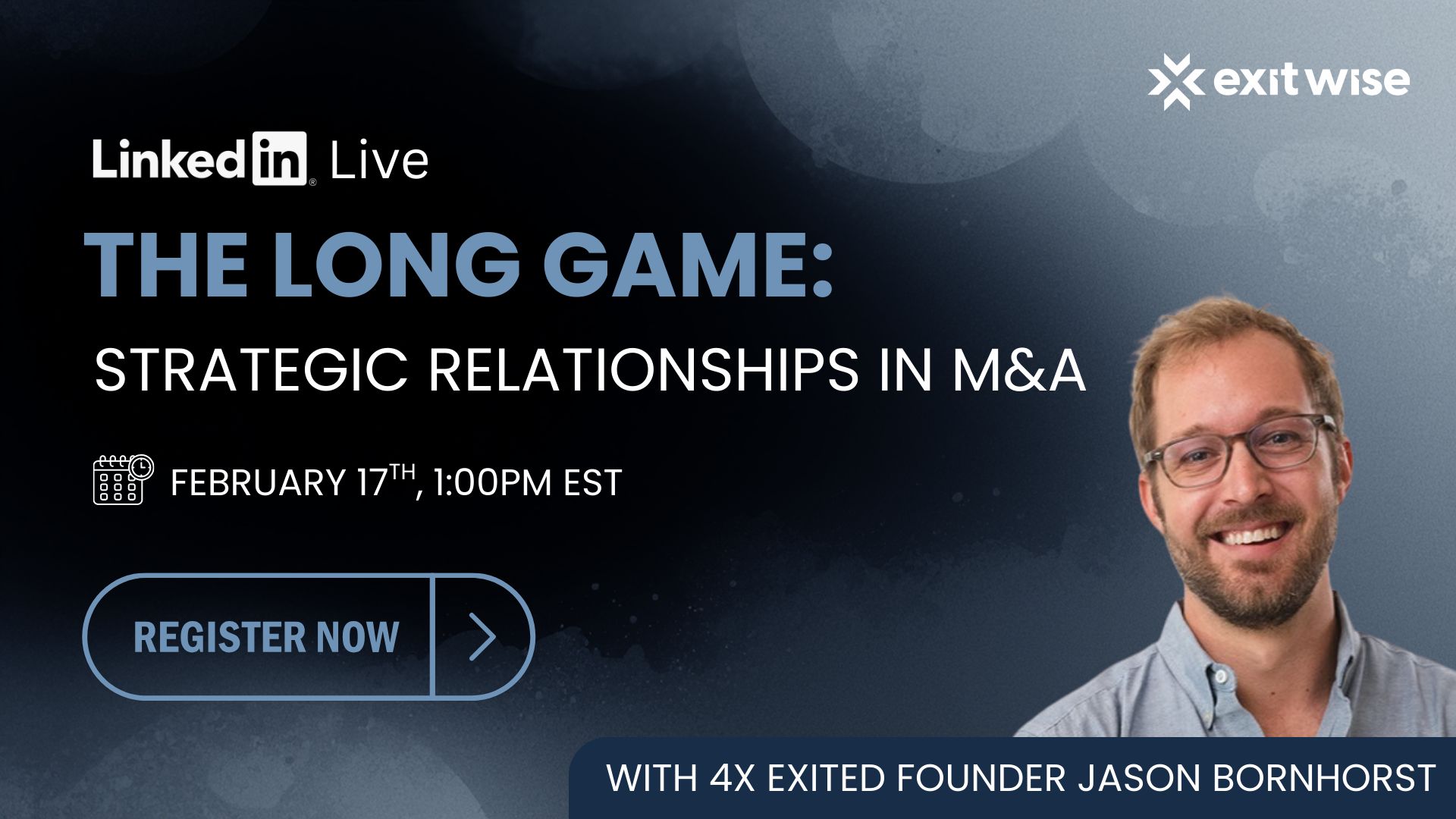

The Compounding Power of Trust: A 4x Exit Masterclass

In a world of "quick wins," serial founder Jason Bornhorst plays a different game.

Jason didn't just wake up one day and sell companies to Expedia and athenahealth. Those exits were the result of a "Long Game" strategy; one built on the belief that trust is the most valuable asset in M&A. By the time the paperwork was signed, the relationships with the buyers' leadership teams had been maturing for years.

On February 17th at 1 PM EST, we’re sitting down with Jason and Exitwise’s Todd Sullivan to discuss how a "relationship-first" approach changes the trajectory of a deal.

In this session, we’ll explore:

The Multi-Year Relationship Arc: Why the best exits are built on rapport established long before a transaction is even on the table.

Direct Access to the C-Suite: How to cultivate deep, authentic relationships with executives at your target buyers so you are a "known quantity" when it matters most.

Customer-to-Partner" Framework: A deep dive into starting with a customer relationship and nurturing it into a strategic partnership that naturally matures into an acquisition.

The Reputation Dividend: How Jason’s track record of being a "safe pair of hands" for leadership teams allowed him to bypass the typical friction and "deal fatigue" of due diligence.

Don't wait for an LOI to start your M&A journey. Join us on LinkedIn Live to learn how to build the relationships that make your next exit inevitable:

💡 This Week’s Big Idea

How to Uncover What Your Business is Actually Worth

When founders think about their business valuation, they often imagine a tense negotiation where they're disputing over EBITDA multiples and deal comps with a buyer on the other side of the table.

But the truth is, the real work happens long before you ever get to that point.

Because if you don’t know what your business is worth (and why), someone else will tell you. And it’ll be on their terms.

That's why a credible business valuation isn’t just a number. It’s a strategy tool. It shows you how your business would be perceived by a serious buyer, and more importantly, where it falls short.

I hear stories all the time of founders who are shocked to learn their business wasn’t worth nearly as much as what they thought it was.

They didn’t have a bad business by any means. They just hadn’t built it the right way to attract strategic buyers. They weren’t tracking the right metrics, had customer concentration issues, or had value drivers that weren’t well documented.

On the flip side, I’ve seen founders increase their valuation by millions just by knowing what actually drives the number up (and fixing what pulls it down).

The point is, a professional valuation gives you that roadmap.

If you want to see what your business is worth today so you can start preparing for the future exit you deserve, just reply to this email. We’re always happy to help.

❓ 5 Key Questions to Ask Yourself This Week

1️⃣ When was the last time I reviewed how my current sale process strategy builds buyer investment and effort?

2️⃣ Do my potential buyers have to work for increasing bids, or am I giving them a pass on effort early?

3️⃣ Is my current process opening the door to incremental bidding, or am I encouraging positional bargaining?

4️⃣ How many real, vetted buyers are in my acquisition universe right now, and do I know where to find them?

5️⃣ Where in the process am I unintentionally sending signals that reduce competition?

📋 3 Action Items for This Week

☑️ Map your acquisition universe and segment buyers by fit and firepower: Don’t just list names. Categorize them based on strategic value, ability to pay, and likelihood of investing effort.

☑️ Outline your bidding rounds and signal structure: Decide in advance when you'll ask for revised bids, what information triggers escalation, and what qualifies someone for management meetings.

☑️ Plan how and when you'll introduce drafts of legal documents: Price isn’t the only bid. Terms matter too. So start deciding when the purchase agreement feedback becomes part of the process.

That’s all for this week. Remember that a great exit isn’t measured by whether someone shows interest. It’s measured by how deeply buyers actually commit to what you've built.

If you want help thinking through your process design or buyer strategy, reply to this email or contact us here. We're always happy to walk you through your options.

Talk next week,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.