- The Wise Exit

- Posts

- How to Know When It’s Actually Time to Sell Your Business

How to Know When It’s Actually Time to Sell Your Business

The signal no one talks about:

Welcome back to another edition of The Wise Exit newsletter. This week, we’re covering:

Why exit timing is one of the most underrated aspects of a sale

5 brutally honest questions to help you recognize the right window

3 actions to help you avoid the “I should’ve sold sooner” trap

Let’s dive in.

💡 One Big Idea

The Exit Signal: How to Know When It’s Actually Time to Sell Your Business

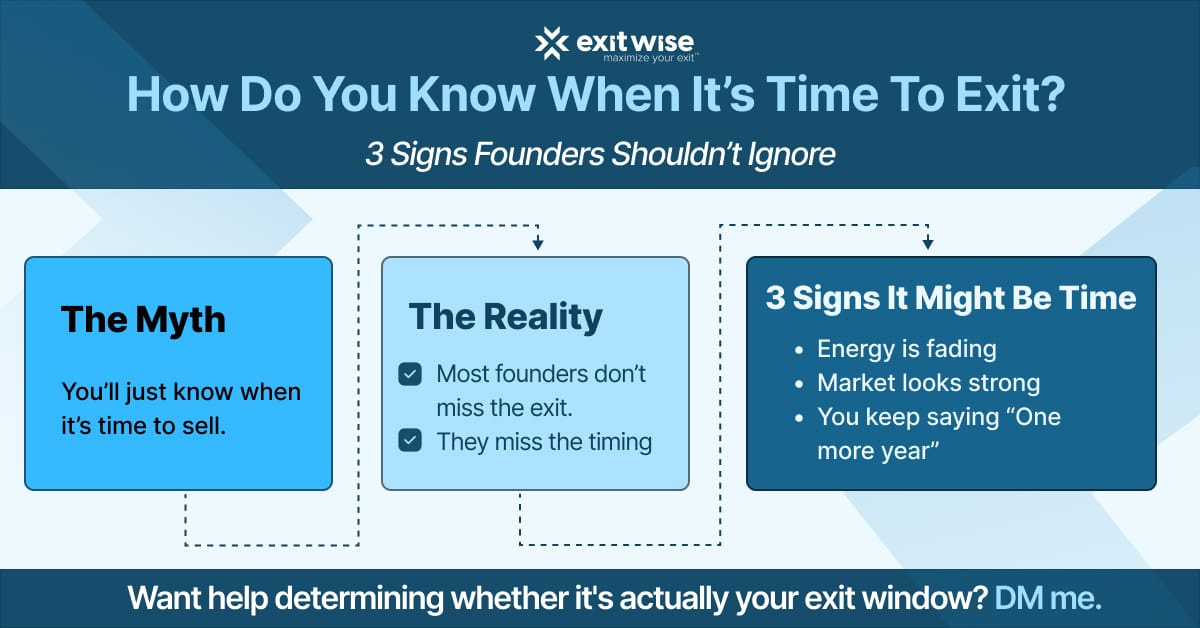

I often talk to founders and business owners who just assume they’ll know when it’s the right time to exit.

But the reality is, exit timing rarely feels clear. And more often than not, the signs show up too late:

Growth is slowing

Team morale is slipping

You're burnt out but hanging on

A buyer appears, and you're caught unprepared

The truth is, most founders don’t plan their exit window. They react to it.

They simply wait for some external event to force their hand, or tell themselves they’ll figure it out “after one more good year.”

But the best exits aren’t reactive. They’re intentional.

They happen when the founder is emotionally and financially ready to walk away, not exhausted and running on fumes.

Knowing your exit signal isn’t about hitting some arbitrary number.

It’s about aligning your business performance, market conditions, and personal goals so you can exit while you’re still in control.

If you miss that window, you might still get out. But it's rarely on your terms.

Your Action Items:

Define your personal “why not yet” list: What are you telling yourself must happen before you consider selling your business? Revenue targets, team hires, market wins? Write them all down, then ask which ones are truly essential.

Study the last 18 months of performance: Is the business trending up, plateauing, or declining? Most founders wait too long, and that slope often matters more than the size of the hill.

Have a “what if” conversation with your #2 or advisor: What would it look like to exit sooner? How would you feel? What might you regret? Bringing those thoughts into the open is where clarity begins.

Want help walking through any of this? Just reply to this email or drop me a DM. I’m always happy to share a few tips that'll better prepare you for your exit.

❓ 5 Key Questions to Ask Yourself Today

1️⃣ What's changed in the last 6–12 months in your business or personal life that makes you even consider selling right now?

Most founders think about selling for a reason. Make sure you know yours.

2️⃣ If you weren’t the founder, and you were advising the company yourself, would you say this is a good time to exit? Why or why not?

Distance reveals truth, so think about it from the outsider’s lens for a moment.

3️⃣ Is your energy building or quietly fading? How would that impact your ability to lead over the next 24 months?

Momentum is everything, but it can’t outrun fatigue.

4️⃣ What external signals are you seeing that might suggest your market is near a peak or your business is becoming more attractive to buyers?

You don’t have to time it perfectly. But you should spot the trend.

5️⃣ If you waited another 3 years to sell, and conditions worsened, what would you regret more — selling too soon or not selling soon enough?

Regret is often a better compass than ambition.

📋 3 Action Items For This Week

☑️ Write your “Why Now” narrative in one paragraph: If you had to explain to a buyer or partner why this year (not last year and not next year) is your window to sell, what would you say?

☑️ Chart your performance trend over the past 18 months: Look at revenue, profit, margin, and customer growth. Is the slope up, flat, or down? Trends often tell a better story than snapshots.

☑️ Pick one trusted advisor and ask them, “What signs would you look for if this were your company and you were thinking about selling?” The right questions reveal more than the right answers.

That’s all for this week.

Remember that timing your exit is one of the few things you can control, but only if you’re paying attention to the signals you're getting.

And if you’re not sure whether your exit signal is showing up yet, hit reply to this email or DM me with the word "EXIT." I’m always happy to help you think through it.

Until next time,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.