- The Wise Exit

- Posts

- How to Extract Deal Leverage Without Giving It Away

How to Extract Deal Leverage Without Giving It Away

The two types of information you need to understand

Welcome back to another edition of The Wise Exit newsletter.

This week, we're covering:

How to extract deal leverage without giving it away

5 questions to help you protect your leverage

3 actions you can take this week to avoid weakening your position

Let’s dive in.

💡 This Week’s Big Idea

How to Extract Deal Leverage Without Giving It Away

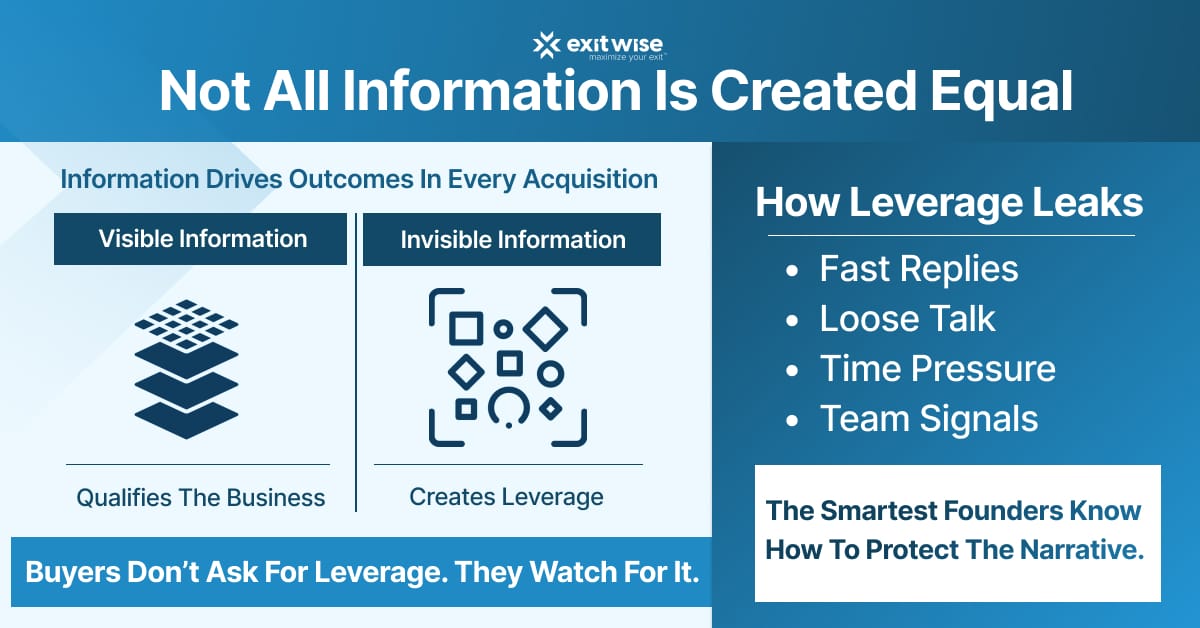

Information is one of the most important (yet overlooked) parts of a business acquisition. In any M&A process, there are two very different types of information at play:

Information that qualifies your assets: This is the obvious stuff — financials, contracts, customers, legal structure, operations. It explains what the business is.

Information that creates leverage: This is the "dangerous" stuff, if you're not careful — motivation, urgency, alternatives, personal pressure, internal risks. It explains who needs the deal more.

Your job as a seller isn’t just to disclose information. It's also to extract as much of it as possible from the other side, while carefully controlling what you reveal about yourself.

This is where founders often get tripped up.

While asset-level information is usually gathered through direct questioning, leverage-level information works differently. And direct questions at the wrong time can completely backfire. They raise red flags, signal intent, and can hand leverage to the wrong person.

A simple example of this:

Let’s say you have a key account executive with deep customer relationships. If they left, it could negatively impact your deal.

Now, while you could sit them down during a contract renegotiation and start asking pointed questions about client dependence, you've now created a problem:

They’ll ask why you’re asking

They’ll start connecting dots

And suddenly, they may have leverage over you

That's why the smarter move is separation. Ask questions outside the context of the negotiation. Gather insight over time, observe behavior, and cross-reference what you hear with what you see.

Reason is, once leverage-related questions collide with a live negotiation, you either have to reveal more than you should or completely lie.

And neither option ends well.

This principle applies even more when you're dealing with buyers. Because buyers will probe constantly. Sometimes directly. Often indirectly. But frequently it'll be through casual conversation like dinner before a meeting, small talk about travel plans, or comments about timing, burnout, family, or “what’s next.”

None of it's accidental, either. Every buyer is trying to answer the same questions:

How badly do you want this deal?

How much time pressure are you under?

What happens if this falls apart?

And every answer you give, whether intentionally or not, shifts leverage.

In the most successful exits, the seller understands this. So they listen more than they talk, ask questions, watch how buyers behave under pressure, and track responsiveness, urgency, escalation, and tone.

In an M&A deal, leverage isn’t declared. It's revealed slowly, quietly, and often, unintentionally.

Reply to this email if you’re currently in a process and unsure what information you should (or shouldn’t) be sharing. I’m always happy to help.

❓ 5 Key Questions to Ask Yourself This Week

1️⃣ What information about my business is purely factual, and what information could weaken my negotiating position if revealed?

2️⃣ Where might I be answering questions out of habit, politeness, or transparency rather than strategy?

3️⃣ Have I separated information-gathering from active negotiations, or am I mixing the two?

4️⃣ What signals am I sending buyers through my behavior, responsiveness, and urgency?

5️⃣ Who on my team understands the difference between qualifying assets and protecting leverage?

✅ 3 Action Items for This Week

☑️ Audit what information you’re currently sharing with buyers: Review emails, decks, and conversations. Then, ask yourself what’s necessary and what’s optional.

☑️ Create distance between negotiations and information-gathering: If you need insight from employees, customers, or partners, gather it outside of active contract discussions.

☑️ Slow down your answers during buyer conversations: Pauses, deflections, and follow-up questions are tools. Use them intentionally instead of filling the silence.

That’s all for this week. Remember, deals aren’t lost because of what you don’t know. They’re more often lost because of the information you reveal too early.

Reply to this email or contact us here if you want help protecting leverage during your exit process.

Talk next week,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.