- The Wise Exit

- Posts

- 5 Ways to Accelerate Your Business Sale

5 Ways to Accelerate Your Business Sale

+ The inside story of a Facebook acquisition

Welcome back to another edition of The Wise Exit newsletter. This week, we're covering:

5 simple steps to speed up your business sale

What not to do when trying to sell fast

How to avoid costly mistakes when buyers move quickly

Let’s dive in.

This Week's Announcement

When the Tech Giants Keep Calling: The Inside Story of a Facebook Acquisition

Most founders spend years trying to get on the radar of a major acquirer. But for Ben Lewis, it was the opposite:

Facebook saw the value in what he was building, and they didn't want to take "no" for an answer. On the morning of Facebook’s historic IPO, Ben officially closed the sale of his company, Karma, to Mark Zuckerberg.

On January 21st at 1 PM EST, we’re sitting down with Ben for a candid conversation. In this session, we’ll explore:

The Power of Being Pursued: What Ben’s experience teaches us about building a company that tech giants actively seek out.

The Talent Premium: Why major acquirers are currently prioritizing "talent density" and how to highlight your team's value during a deal.

The Modern M&A Roadmap: How tech giants evaluate acquisitions in 2026 and what they are looking for beyond just the bottom line.

This is an insider’s look at the mechanics of a major exit. Join us with your questions on LinkedIn Live and register for free below:

💡 This Week’s Big Idea

How to Sell Your Business Faster (Without Undervaluing It)

Speeding up a business sale sounds great on paper. You've got less time in the market, fewer buyer calls, and shorter diligence cycles.

But move too fast, and you risk selling for less than your company's worth. Or worse, killing the deal with mistakes that could’ve been avoided in the first place.

When selling your business quickly, the goal isn't to rush. It's to remove as much friction as possible.

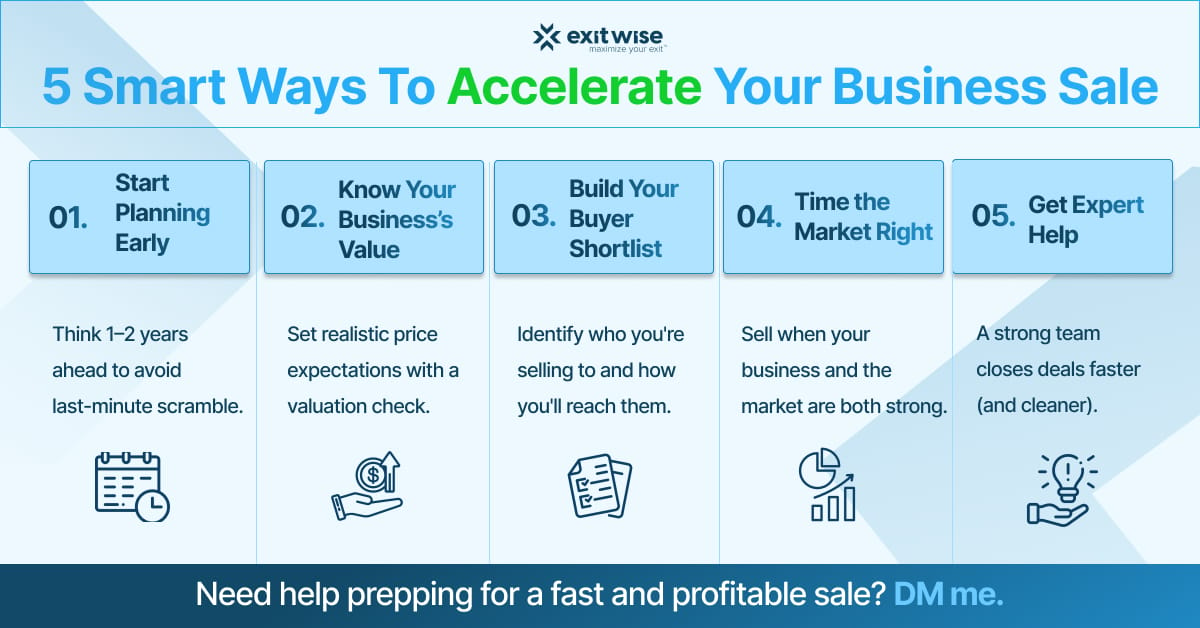

Here are 5 ways to do that:

Start your exit planning earlier than you think:

Start building your exit muscle before you ever go to market. It gives you more time to prep documents, upgrade financials, and spot risks buyers will catch. The result? Faster, cleaner deals when you're actually ready to sell.

Market your business strategically:

Don’t blast it everywhere. Get clear on who your ideal buyer is, whether that's a strategic, a financial sponsor, or an insider. Then, build a plan to reach them directly. The more focused your outreach, the faster you can get serious offers.Know your valuation range:

Guessing here only leads to overpricing or leaving money on the table. That's why I'd recommend working with experts to establish a fair market range early so you can confidently set expectations and avoid wasting time with unqualified buyers.Time the market (and your business):

You’ll sell faster if you're thriving and the market is favorable. If your company’s growing, your team is stable, and your sector is hot, don’t wait to sell. Buyers move more quickly when everything is pointing up and to the right.Hire professionals to run the process:

Trying to run your business and sell at the same time is a recipe for burnout. A strong M&A team speeds up every step in the process so you can avoid common pitfalls that delay or kill deals.

At Exitwise, we help founders build the right strategy, hire the right team, and move at the right pace, so speed never comes at the expense of value.

Shoot me a DM on LinkedIn or reply to this email if you’re thinking about selling and want to know where to start. I'm always happy to point you in the right direction.

❓ 5 Key Questions to Ask Yourself This Week

1️⃣ If I got an inbound offer today, how quickly could I get my financials and legal docs ready?

It doesn't have to be perfect. But you should be organizing these things early on.

2️⃣ Do I know who my ideal buyer is and how to reach them directly?

If the answer's no, start there.

3️⃣ Have I gotten a third-party valuation in the last 12 months?

Valuations like these are a great way to determine where your business is at and what you still need to improve to maximize your exit.

4️⃣ Is my business in a strong position right now (financially, operationally, culturally)?

If not, start thinking about the low-hanging fruit that will change that. Then take action.

5️⃣ Have I talked to a professional about what a fast sale would actually look like for my business?

Every business sale is different, so you should know where yours stands.

3 Action Items for This Week

☑️ Run a valuation check-in with an M&A advisor or finance lead: Knowing your ballpark value helps anchor your timeline, pricing expectations, and buyer conversations.

☑️ Build a shortlist of 5 potential buyers and how you’d reach them: The more clarity you have on your ideal acquirer, the more efficient your outreach (and your sale process) becomes.

☑️ Start collecting your financial, legal, and operational documents into a central folder: Having these ready early eliminates delays later on, especially when diligence starts moving fast.

That’s all for this week.

Remember, a faster exit isn’t just about working harder. It’s about preparing smarter. If you need help with any of the above, reply to this email or contact us here.

Talk next week,

Brian Dukes

Managing Partner at Exitwise

What's the ONE Thing You Need the Most Help With Right Now? |

Whenever You're Ready, Here Are 3 Ways We Can Help You:

1. Get a quick (and free) read on the value of your business

Curious what buyers might pay for your business today? Run the numbers through our free valuation calculator:

2. Get a full breakdown of what your business is worth

Want a detailed breakdown of what your business is worth today? Our expert team will build your buyer profile, highlight risks, and tell you exactly how you can increase its value:

3. Need help selling your business?

If you’re preparing to exit your business, we’ll help you build the right plan and connect you with the right buyers.